Free Non Profit Donation Receipt Template

Yes must be listed to confirm the entitys non-profit status. A Donation Request Letter Template is a document that is sent to an individual or a potential lead that will donate for fundraising created by a non-profit organization.

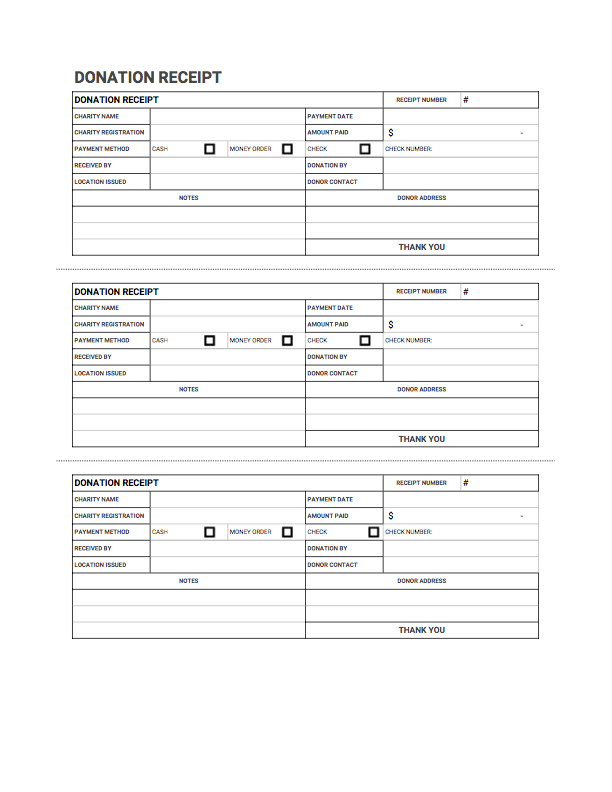

Free Donation Receipt Templates Samples Word Pdf Eforms

It is important that this letter shows the purpose of the event and how will the recipient send donations.

. Free Download Donation Sheet Template Pdf. Use Excels classic blue sales receipt to provide detailed payment information to your customers. The bottom line is a donation tracking template will make your life a lot easier.

Donation Sheet Template Pdf Free Download. Non-Cash Charitable Contribution Worksheet. A lot of non-profit organizations give out their donation receipts at the end of the year when the donation has been given or in the first month of the next year.

These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. The receipt used to document a Goodwill donation can be accessed with the Adobe PDF link above. Select it then download this file.

There are many things you can do to make sure your receipt includes everything and still looks impressive. Name of the Non-Profit Organization. A donation acknowledgement letter is used by the receiver of the donation to assure the sender that they have already received either the amount of money given or any kind of help being extended by the person who gave the donation.

With a template you can customize the perfect receipt for your. By providing receipts you let your donors know that their donation was received. This sales receipt offers formatted fields for taxes discounts unit prices subtotals and more.

1 Save The Goodwill Receipt Template. Management staff must also provide their signature title and the signature date. Then you can also use it to keep track of.

You can use a donation chart tracker or even a fundraiser thermometer template. A member of the management staff must verify that the donation receipts match the completed form and fill in the date of donations in this section. The statement On Publication 78 Data List.

It would be wiser though to give out donation receipts and acknowledge the donations a lot sooner so that donors or benefactors would be encouraged to make contributions again in the future. If you have compatible software you may enter information onscreen however many would consider it wise to have such paperwork in a readily accessible location in your system. Any of these will serve the same purpose and give the same benefits.

Also make sure that your template for the non-profit donation receipt is both professional and versatile. Charitable Donation Receipt Form. 2 Give Manifest.

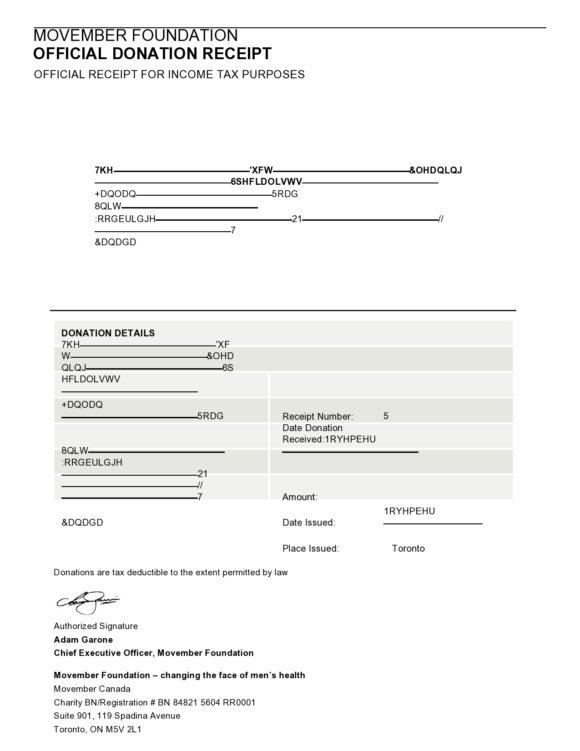

Registered nonprofit organizations can issue both official donation. A Microsoft receipt template is just the ticket. A great way to achieve this is by downloading a template.

In addition Goodwills name Goodwill Retail Services Inc store address and identification number 39-2040239 must be completed. Download What All a Donation Template. Sample 501c3 Donation Receipt DONATION RECEIPT.

Use it to track all the charitable donations made in your organization. There are many things that you can put in a donation acknowledgment letter but the main point that you should not forget is to relay all the. Goodwill Industries of Northern New England.

Each printable receipts template is free customizable and works well in a variety of situations. A donation receipt is a written acknowledgment that a donation was made to a nonprofit organization.

Donation Receipt Template Download Printable Pdf Templateroller

Free 20 Donation Receipt Templates In Pdf Google Docs Google Sheets Excel Ms Word Numbers Pages

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Free Downloadable Templates Invoice Simple

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Templates Silent Partner Software

Free Donation Receipt Templates Silent Partner Software

Comments

Post a Comment